9.4 Government to Business (G2B)

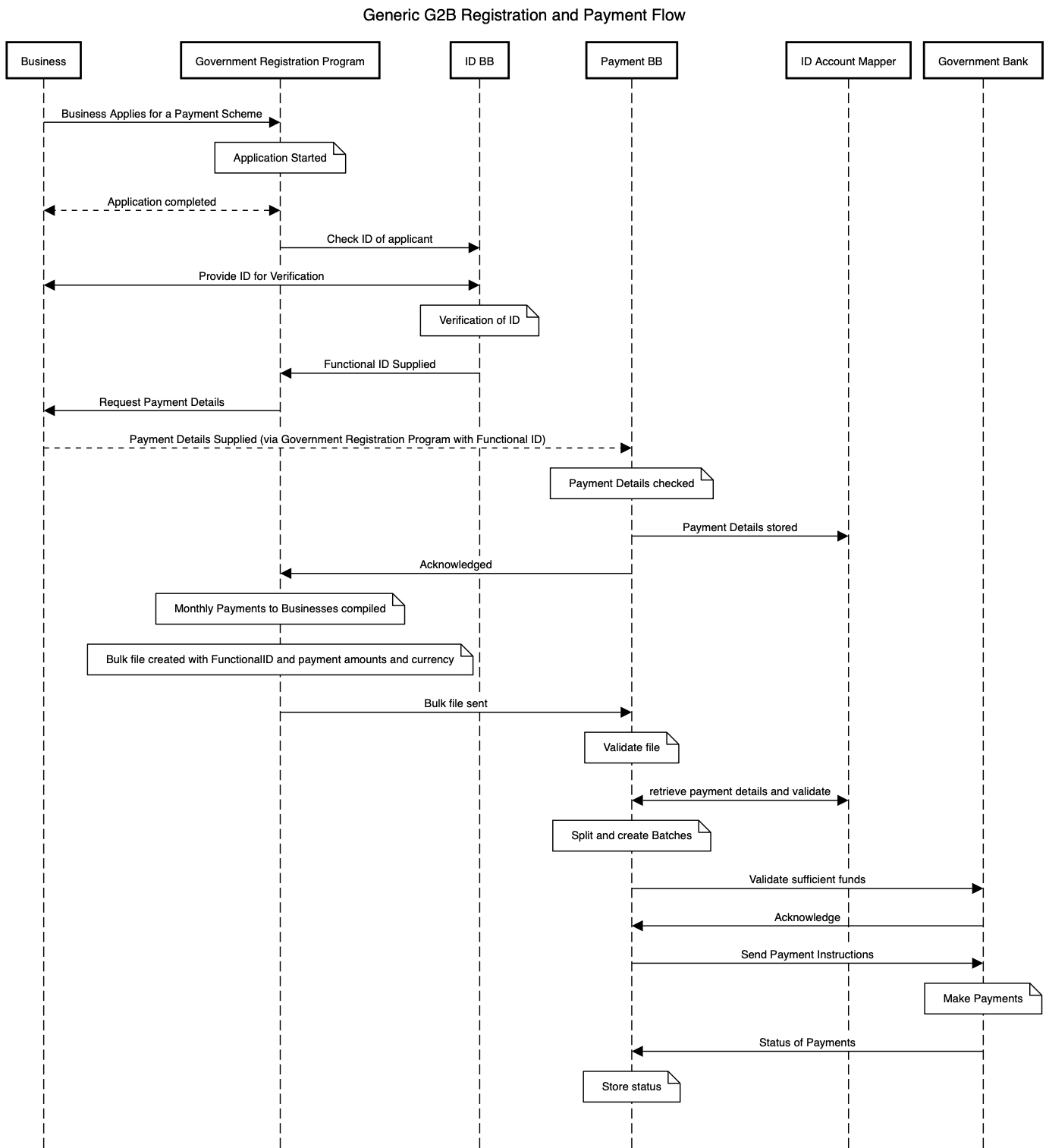

9.4.1 Generic G2B Workflow for Registration and Payment

The following diagram shows a happy path generic workflow for Registration and Payments for a G2B scheme:

Assumptions:

That the Government Registration Program is a BB such as the Registration BB

KYC - “Know your Customer” is inclusive of KYB “Know your Business”

All interactions with the Payment BB will go via the Information Mediator BB as per GovStack specification even where not shown for clarity in the workflow

Workflow covers:

Registration Flow and storing of Payment Details

Payment flows

Workflow excludes:

Audit

Unhappy path flows

Key callouts:

There may need to be 2 ID’s verified, that of the Business and that of the Individual acting on behalf of the business (TO BE EXPLORED).

Currently in the workflow existing Pay-BB API definitions can be used

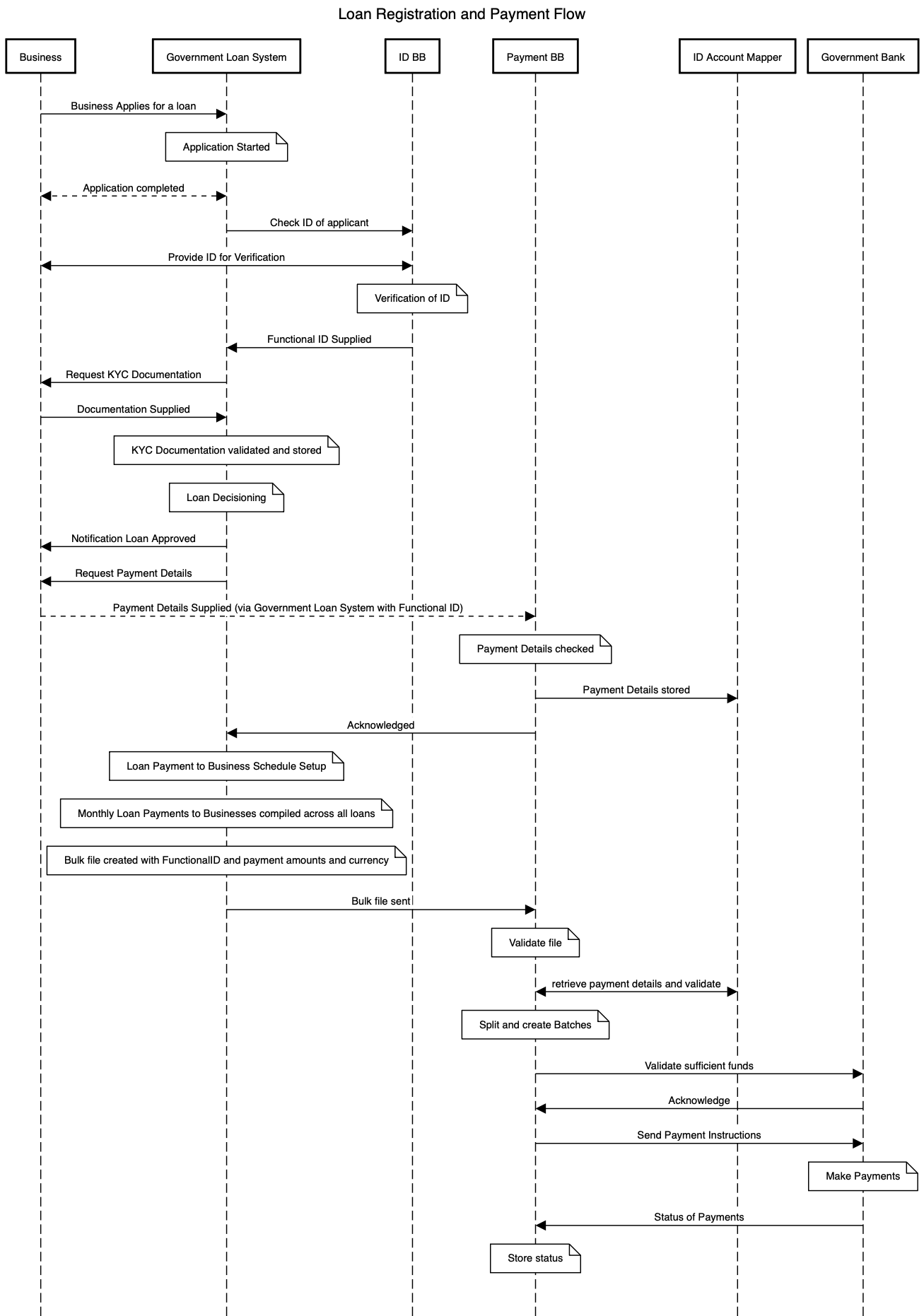

9.4.2 Example workflow for Government to Business loan

In this example the government has a scheme where they provide loans to small businesses on preferential terms to encourage small business development. This example could also apply to small business loans needed for disaster recovery (The UK offered such loans during Covid19).

Assumptions:

That the loan scheme is not part of the Payments BB (could be an independent system or BB that is yet to be defined)

KYC - “Know your Customer” is inclusive of KYB “Know your Business”

This is giving an example loan scheme but is not inclusive of all steps within that as we are not defining the loan-scheme in this BB

This example covers a normal Business type loan, it is not intended for guarantee loans where the Government is not the loan provider

All interactions with the Payment BB will go via the Information Mediator BB as per GovStack specification even where not shown for clarity in the workflow

Workflow covers:

Loan Setup and Payment

Workflow excludes:

Loan Repayment flows these would be a B2G flow

Audit

Unhappy path flows

Detail of Loan system internal flows

Key Callouts:

There may need to be 2 ID’s verified, that of the Business and that of the Individual acting on behalf of the business (TO BE EXPLORED).

Identity BB currently only considered individual ID therefore this has an impact on the current identity BB specification

Currently in the workflow existing Payments BB API definitions can be used (needs to continue to be assessed with any changes)

Was this helpful?